The introduction of the Ethiopia Commodities Exchange (ECX) in 2008 was a disaster for the Specialty Coffee Industry. The system of sale obscured any information relating to the coffee beyond its region. Basically, it wiped out traceability. Recent changes however, have dramatically improved the situation.

What is the ECX?

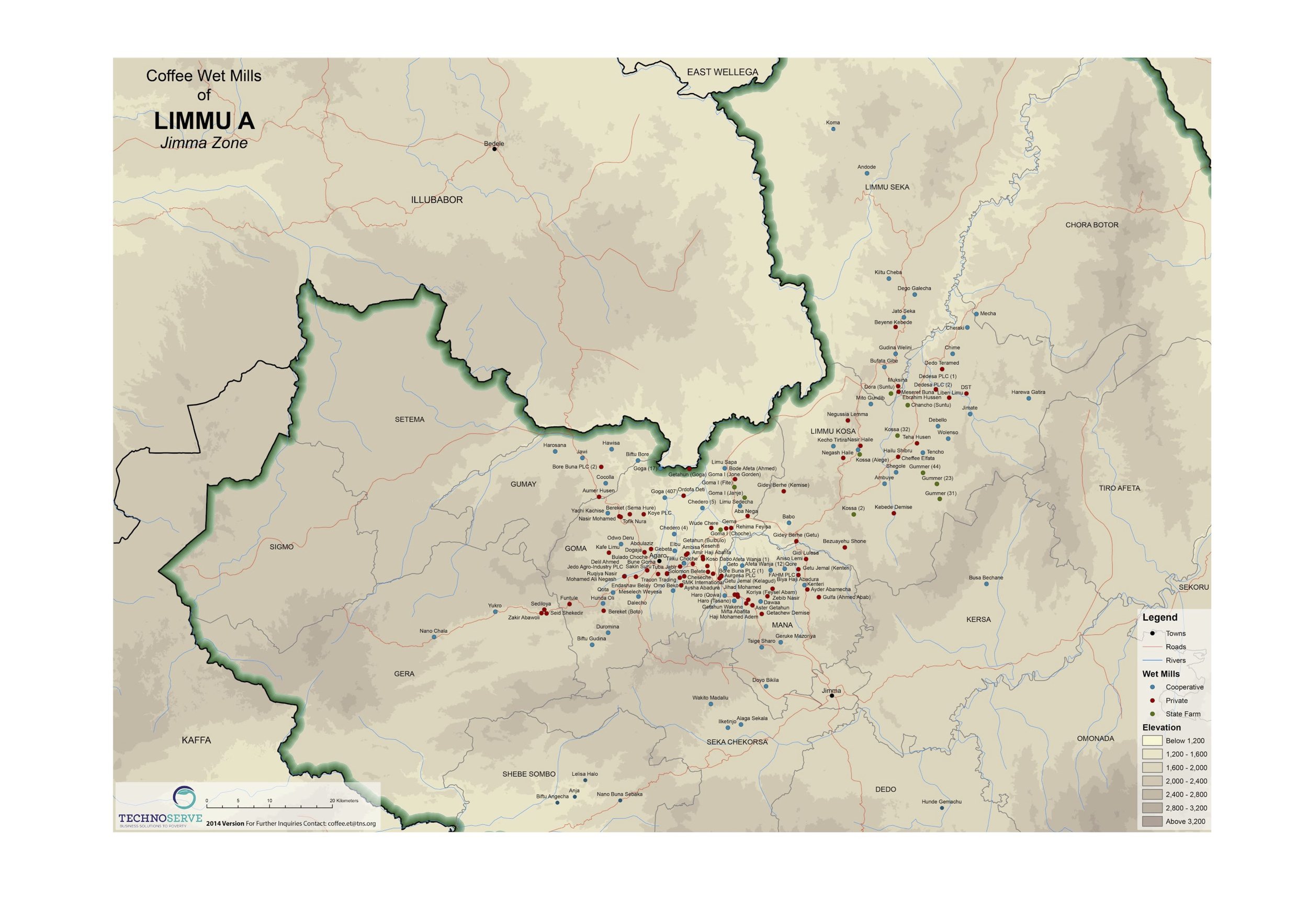

The ECX is a private company made up of both private parties and the Ethiopian government. Upon its inception in 2008, all coffee in Ethiopia had to be sold through the ECX. Initially, it enforced a system where smallholders sold their cherries to a ‘collector’, who in turn sold to suppliers/washing stations. Collectors had to obtain licenses in order to buy from their specific areas (e.g. Kochere). They were only allowed to buy from their specific areas.

Once processed by a washing station, coffee was delivered to the auction in Addis and was cupped and graded by the Coffee Liquoring Unity (CLU). Auctions happened every day and exporters had the opportunity to see, but not cup the samples, and knowing only the coffee’s region, made their purchasing decisions.

In a newer version of the auction, which was implemented soon after the first, collectors were eliminated, and centralized marketplaces were implemented. Rather than suppliers buying from collectors or specific smallholders, they bought from centralized markets and cherry prices are based on ‘market price’.

CHANGES TO THE ECX IN 2018

The ECX has grown quite expansively over the years. Of the 600,000+ metric tons of product sold through the exchange, coffee makes up only 3,000 metric tons. Still, 6.5 million pounds is no small number, and it requires a large amount of infrastructure.

The inception of the ECX was a step backwards for the specialty coffee industry. In the process of being sold on the ECX, coffee lost all traceability. Not only did coffee origins become anonymous beyond a region, information about the cup profile was also often unavailable until after a coffee was purchased.

Fortunately, the ECX is improving, and for this harvest we have seen huge steps taken to keep the coffee, and its vital information, together.

The ECX now relies on an electronic auction system for access to data related to a particular product and all related transactions. Not only will this ensure that information stays with the product being sold, it allows a massive expansion of amounts and types of criteria that can be traded along with the product. For coffee, full traceability means reliable data pertaining to where the coffee was grown, down to the Woreda (district) or washing station. It also means better physical or sensorial data such as cup score, moisture content, and water activity of the coffee. Additionally, the ECX has revised its grading system for both washed and sundried coffees to improve the accuracy, reliability and consistency of scores.

Our long-time partner in the region, Heleanna Georgalis of Moplaco, was initially skeptical about the promised changes. She has been in Ethiopia long enough to know promises and action are not always the same thing. However on our latest trip to Ethiopia Heleanna was optimistic, and said the changes have been successful thus far. For the first time in many years, she is encouraged by the direction the ECX is headed.

Want more updates like this?

Stay up to date with this and other changes to the Specialty Coffee Industry by subscribing to our newsletter.