THE QUEEN OF COFFEE ORIGINS

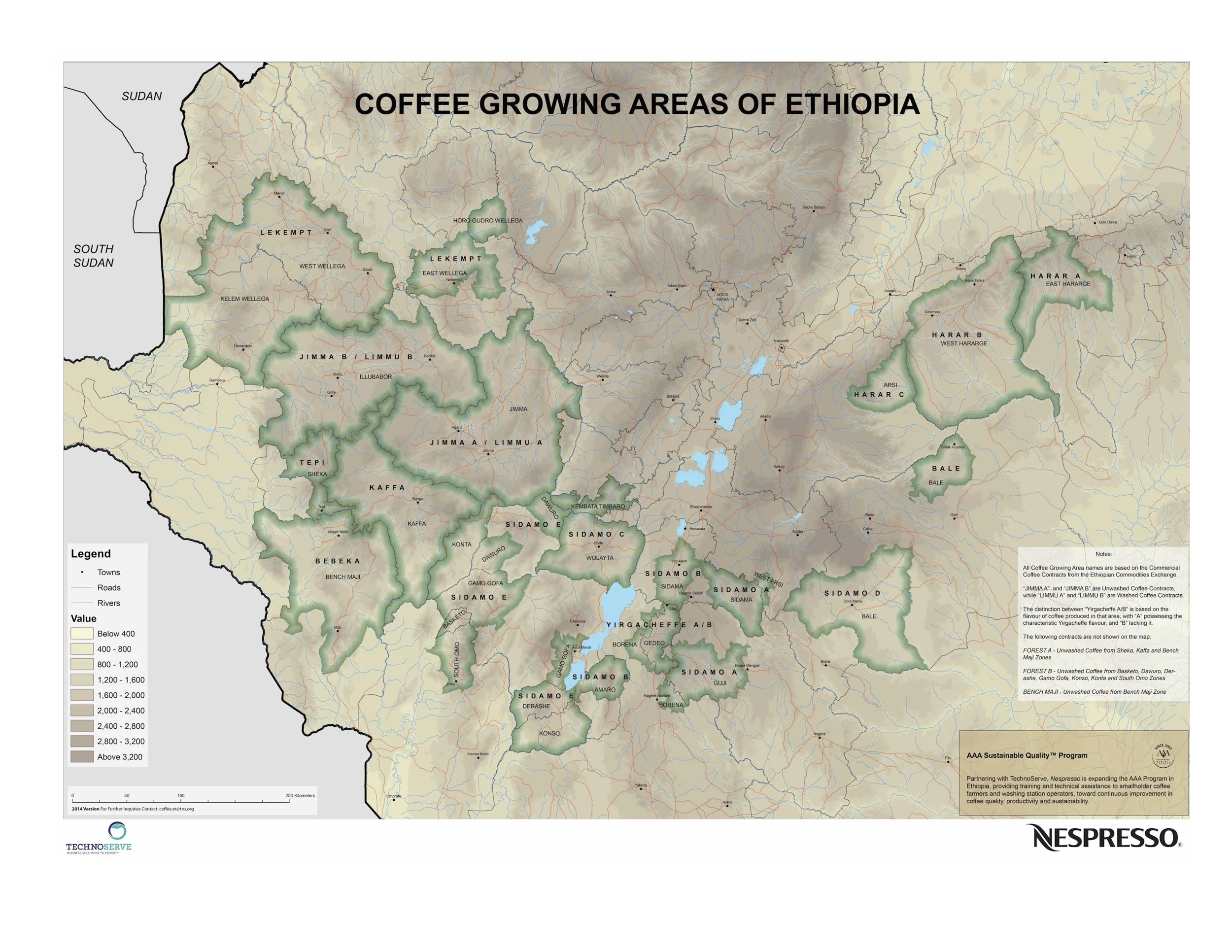

Ethiopian coffees notoriously change the perceptions of coffee drinkers about what coffee can taste like. This is no doubt due to the amazing genetic variety the 'birthplace of coffee' boasts; the vast majority of coffee varieties here have yet to be even categorized. This is perhaps why Ethiopia's coffee sector is so protective, making it one of the most frustrating origins for sourcing. Navigating Ethiopia's labyrinthine and ever-changing coffee politics make finding trustworthy partners absolutely vital. We believe we are working with the best of the best.

Scroll down to

Learn more about the coffee market in Ethiopia;

Meet our partners at origin;

Read our blog posts on Ethiopia;

Download hi-res photos;

See our Ethiopia offers list;

Download coffee information sheets;

See the FOB we paid for all coffees from Ethiopia in 2018.

Moplaco warehouse, Addis Abeba, Ethiopia. These women hand-sort each and every lot as the final QC measure for coffees exported by Moplaco.

history and market

The birthplace of coffee is also arguably the most challenging to work in for a coffee buyer. Coffee is not only an important export commodity; Ethiopian locals are also high consumers of coffee, making for dynamic and competitive local marketplaces. Added to this are protective trade laws and policies that sometimes change overnight without warning. Combined with the most exotic and unique cup profiles and thousands upon thousands of not-yet-known coffee varieties, we suppose it is only fitting that the “Queen of Coffee Origins” is as multi-faceted as she is.

There are three ‘windows’ for buying coffee in Ethiopia: (1) Directly from a private estate that can export their own coffee; (2) From a cooperative that is represented by a union that acts as the exporter; (3) From a private exporter that has a license to buy coffee from the Ethiopia Commodities Exchange (ECX).

The Ethiopia Commodities Exchange (ECX) was established in 2008 and is a private company made up of both private parties and the Ethiopian government. Initially, smallholders sold their cherries to a ‘collector’, who in turn sold to suppliers/washing stations. Collectors had to obtain licenses in order to buy from their specific areas (e.g. Kochere). They were only allowed to buy from their specific areas.

Once processed by a washing station, coffee was delivered to the auction in Addis and were cupped and graded by the Coffee Liquoring Unity (CLU). Auctions happened every day and exporters had the opportunity to see, but not cup the samples, and together with knowing the coffee’s region, made their purchasing decisions.

In the newer version of the auction, which was implemented quite soon after the first, collectors were eliminated, and centralized marketplaces were implemented. Rather than suppliers buying from collectors or specific smallholders, they bought from centralized markets and cherry prices are based on ‘market price’.

Changes to the ECX in 2018

The ECX has grown quite expansively over the years. Of the 600,000+ metric tons of product sold through the exchange, coffee makes up only 3,000 metric tons. Still, 6.5 million pounds is no small number, and requires a large amount of infrastructure.

The inception of the ECX was a step backwards for the specialty coffee industry. In the process of being sold on the ECX, coffee lost all traceability. Not only did coffee origins become anonymous beyond a region, information about the cup profile was also often unavailable until after a coffee was purchased.

Fortunately, the ECX is improving, and for this harvest we have seen huge steps taken to keep the coffee, and its vital information, together.

The ECX now relies on an electronic auction system for access to data related to a particular product and all related transactions. Not only will this ensure that information stays with the product being sold, it allows a massive expansion of amounts and types of criteria that can be traded along with the product. For coffee, full traceability means reliable data pertaining to where the coffee was grown, down to the Woreda (district) or washing station. It also means better physical or sensorial data such as cup score, moisture content, and water activity of the coffee. Additionally, the ECX has revised its grading system for both washed and sundried coffees to improve the accuracy, reliability and consistency of scores.

Our long-time partner in the region, Heleanna Georgalis of Moplaco, was initially skeptical about the promised changes. She has been in Ethiopia long enough to know promises and action are often not the same thing. However on our latest trip to Ethiopia Heleanna was optimistic, and said the changes have been successful thus far. For the first time in many years, she is encouraged by the direction the ECX is headed.

OUR PARTNERS AT ORIGIN

Yanni Georgalis established Moplaco in 1972 and was a third generation coffee exporter. Yanni was highly respected not only within Ethiopia but was well known and beloved by buyers of Ethiopian coffee around the world. He rightfully maintained a reputation for not only selling the highest quality coffee, but also for his integrity in all aspects of the business. Heleanna, Yianni’s daughter, comes from a long and established lineage of highly respected Ethiopian coffee exporters.

Heleanna is a courageous woman and has done an admirable job of continuing the legacy of her father’s at Moplaco while also carving out her own version of it in the years since her father’s passing. Under her leadership, Moplaco is constantly evolving to produce ever-increasing quality coffee in spite of the complexity and challenges continually present within Ethiopia’s coffee production and auction systems. Born in East Harar as a young girl Heleanna was forced to flee her home in the face of civil war and so grew up in Europe, where she eventually established a successful career in finance.

She neither imagined nor planned to return to Ethiopia or to follow the footsteps of her father but after the sudden passing of her father in 2008, Heleanna was at a crossroad: continue the legacy her father had meticulously built with almost no knowledge about the coffee business, or continue on the path she had created for herself within the world of finance. We are very glad and lucky she chose coffee. True to her personality and way of approaching new challenges, Heleanna completely immersed herself in learning about roasting, cupping, agronomy (including the latest research and practices in natural processing) and the niche markets of specialty coffee all around the world. Though she admits that these challenges are extremely daunting at times, Heleanna continues to trailblaze in specialty coffee.

BLOG POSTS

Use the arrows on the right to browse all Ethiopia blog posts.

HI-RES PHOTOS FOR DOWNLOAD

Right click on a photo below and select “Save Image As” to download.

FOB, CCS Ethiopia SELECTION, 2018

See the FOB we paid for all coffees purchased from Ethiopia in 2018.

The FOB represents the price we pay our export partners at origin. To calculate the cost we charge to roasters, we add the following:

Financing and logistics, on average USD $0.3/lb

(USD $0.4/lb for inland coffees such as Burundi).

We work with financing partners as we are an independent sourcing company without the capital to finance coffee. Logistics covers shipping, insurance and other costs to transport coffee from ports at origin to our warehouses located in Oslo, Hamburg, New Jersey and Oakland. This price is only for full containers. When we ship smaller quantities of coffee, like from Panama for example, financing and logistics costs are much higher.Our markup to cover our costs.

The markup varies, depending on the FOB, volumes purchased, and the need to remain competitive in the market. For example, we take a lower margin on our most expensive coffees. On average, in 2018, our markup is 20%.

So the equation for all origins, except Burundi, looks something like this:

Price to roasters per pound = (FOB + US$0.3) x 1.2

Price to roasters per kilo = (FOB + US$0.66) x 1.2

The equation for Burundi looks something like this:

Price to roasters per pound = (FOB + US$0.4) x 1.2

Price to roasters per kilo = (FOB + US$0.88) x 1.2

Please remember, these are averages.