By Robert W

We are in Addis making 2019 selections. The harvest is over, samples are in from the fields, and we are cupping day-in and day-out in the labs, also checking out the dry mills we’ll be using, and planning shipping with our exporters. It is sizzling these days.

The whole country is on the move, the economy is the fastest growing in Africa they say, God knows what the actual substance behind it is. The roads and streets of Addis are steeped in white and blue, the colors of the infamous Lada taxis, and while the traffic is frenetic, smoky, smelly and congested, most of the city’s neighborhoods are walkable. It can be busy, but it feels friendly.

The townscape is a patchwork of new and old, a mix of grace and misery. Humble shacks neighbor grandiose houses with tranquil gardens, tossed between tacky malls and office complexes, sprinkled with new hotels of glimmer and the latest in luxury. Looming over it all are half built concrete structures, above the traffic and the people, above the herds of goats and heaps of gravel, like shrieking skeletons. Addis is a construction site, it’s a place in progress.

This is where we find ourselves; trying to settle in, establishing a CCS presence in the midst of a city, at the ebb of a harvest, and at the flow of an upcoming export season. What’s happening, what’s new, what’s worth sharing?

We know that the Ethiopian economy is driven by the coffee sector. Coffee is culture and cash to this country, it is a source of pride of the people, and a source of foreign currency to the government. In a political environment of pushing economic growth, helped by a targeted liberalization, the national ambition is getting more coffee out — and getting more dollars in.

It feels a bit like the wild west here, in the capital of coffee, on the Eastern Horn of Africa.

Many farmers and washing station owners are taking advantage of opportunities of getting closer to the market, even Ethiopians who have lived abroad until recently are coming back home to join the party. Export licenses are more easily obtained, even by players without the technical or financial means, and some without the expertise in coffee quality or market knowledge. Way before a bag of coffee can leave a harbor, it goes through many processes and is changing hands along the way, and it may even change ownership many times. So, who is in control, what are the systems, is it transparent?

ECX - auction and non-auction lots

Without getting into too much nitty gritty about the ECX system, the minor changes that we have seen in the recent past, whether it is good or not, it is probably wise to remember and acknowledge that ECX is a system that is built to take control of the trade of Ethiopian coffee, for the sake of taking control of the flow of money, or more precisely; the input of US dollars into the Ethiopian economy.

ECX has built an infrastructure of regional inspection points to control the movement of the coffee from the inland out to its market (Addis), but believe it or not, a core component of the system is discovering value. Each truck of coffee going from the washing stations’ warehouses around the country has to stop at a regional warehouse for physical evaluation and cup profiling. Their protocols may be rigid, but the procedures are rudimentary, and in the end, a ‘score’ that a coffee gets from an ECX assessment, for example 90 points, does not have any reference to the score one would give to the same coffee based on a SCA or CoE cupping protocol, which is only based on an organoleptic evaluation.

However, the ECX score is a reference in its own right. The differentiation of quality is used to prove that some lots are more valuable than others, with the intention of fetching a higher price whether at the auction or when sold directly. Which brings us to another point; all coffees, whether bought from the ECX auction or not, whether bought ‘directly from a source’, such as a washing station owner, coop, farmer, or whomever: the lot has to be tested; cupped, and information reported and logged at the ECX regional station before continuing its journey to Addis — where most of the dry milling is happening. This takes time.

The ECX is far from CCS’ primary or preferred way of finding great lots in this origin. We may come across and buy a lot from the auction from time to time, some gems might be found there indeed (just like in Kenya), and it can be a great way of discovering a place and a person, since the source will now be revealed after purchase. And when one buys a lot from the auction, the coffee is already on its way to Addis, so no time is wasted.

We also depend on the ECX system for the coffee that we buy outside the auction, let’s say a lot from a washing station we have a relationship with. It is also screened and assessed at an ECX station before it arrives in Addis. Every time. In this case, a sample cupped in Addis might represent a lot that is still stored in a warehouse close to where it was produced. It may take a month or more before that lot can be milled, bagged and made ready for export.

What to expect this season

Producing coffee, even specialty coffee, in Ethiopia is business as usual. Little changes in picking, processing and drying. The craft is the same, the reasons for making it in such an ordinary way is reasonable, or at least understandable. Exceptions exist, and there are good ones, but they are few.

Most ‘coffee’ farmers don’t sell coffee, they sell coffee cherries, so they are depending on another facility, to buy their cherries for whatever the ‘market’ is offering on that very day. It can range from around 10 Birr per kg of cherries, up to 20-something Birr per kg. The range depends on the geographic area and what moment in the season the cherries are delivered. Whatever the price is, there is no particular incentive in doing it much differently. The value is added to the coffee once the cherries are bought, by which stage the cherry farmer is out of the equation. From the producer´s perspective it looks like this: with an average of 15birr per kg of coffee cherries, from a garden farm with 3-500 trees, producing approximately 3-5kg of fruit per tree, they earn from one harvest an amount that is the equivalent of 3 USD per day.

The people processing those cherries have another economic mindset. They may accept only fully ripe cherries, but there are few places that demand perfection. The coffee cherry is a raw material, a commodity, that may or may not be scrutinized carefully before pulping. Some washing stations may require some selection, but very few would use the floating method or take any other extra step to reduce half mature cherries from what’s going into the hopper.

Producing coffee in Ethiopia means producing a commercial product that the market is not willing to pay more than around $3.50 USD/lb FOB for a top lot of Gr.1 for. So why bother with a ton of labor intensive and expensive procedures, the quality issues can be handled at the dry mill with a color sorter and hand picking, can’t it? Unfortunately no, we know, it can’t.

Drying is where we see even more critical quality concerns. One may think that the drying is done carefully, raked by hand, hand picking defects and so on. Realistically for most facilities, the drying stage is a process that must be achieved as efficiently as possible. Time is money and space is a logistical matter. For example, shade drying which is highly preferred, is almost never seen. Shade drying takes up to three times longer. The surface space needed, and the time required increases the cost of production of the coffee several cents per lb. In the end, is one guaranteed to get that invested money back?

We are seeking those facilities, meeting the right people people, and working with coffee suppliers who take these extra steps. They are few and the coffee is more expensive, but we think it is worth it.

There is a small wave of experimentation with new processing techniques, mostly small volumes. We have yet to see if there are buyers willing to pay for the ride. Often these coffees are targeted at coffee competitors or special lots to be sold at auction. The offer prices reflect a premium for novelty and uniqueness, as well as the extra time invested in making small exclusive batches, thus it is not necessarily in a direct correlation to the cup character alone.

CCS in Ethiopia, February 2019

CCS is building its presence in Ethiopia on many fronts. This origin continues to be one of the most challenging, but still large and important in our portfolio. Succeeding with finding and delivering delicious lots to the world is our reward.

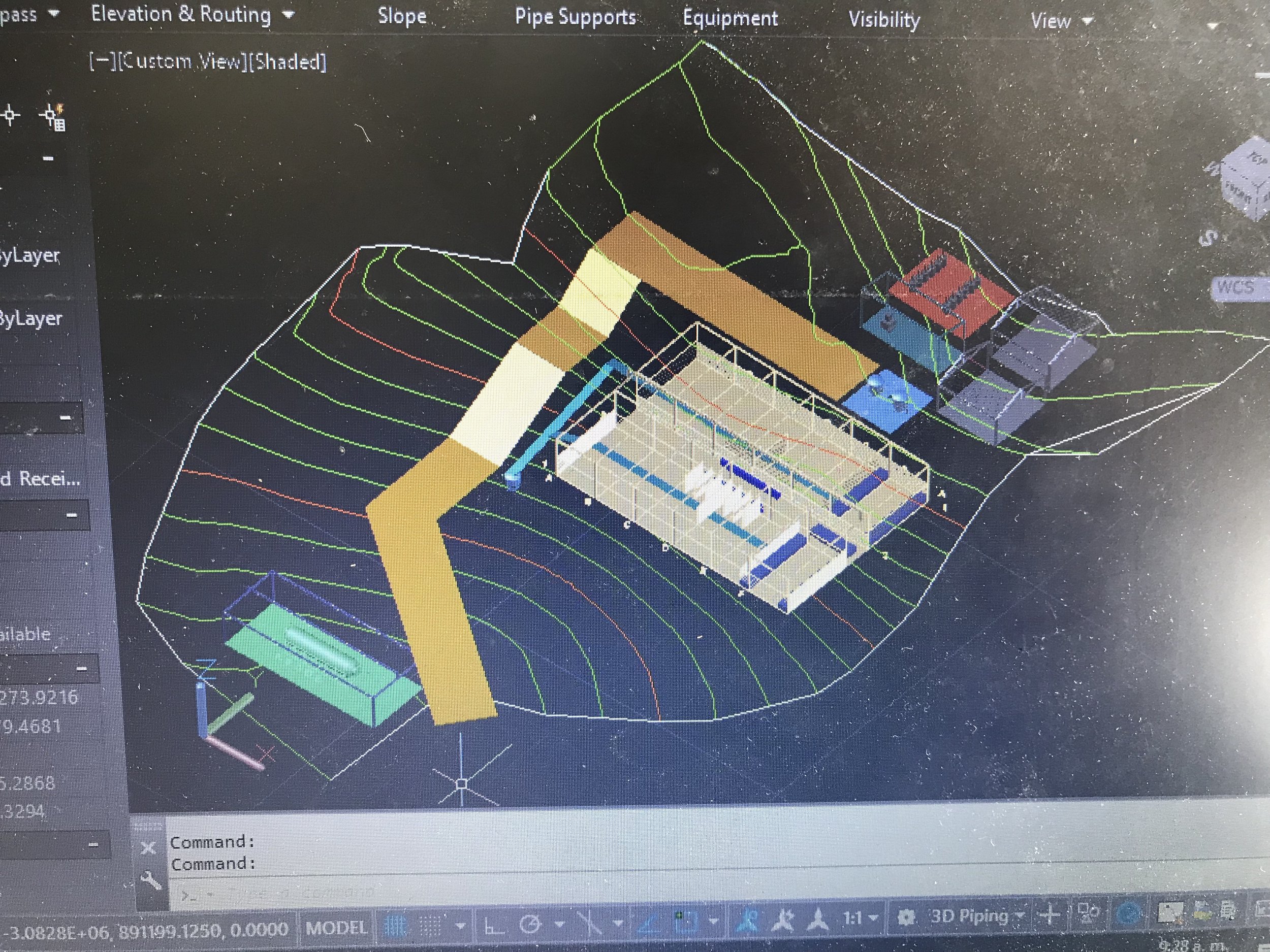

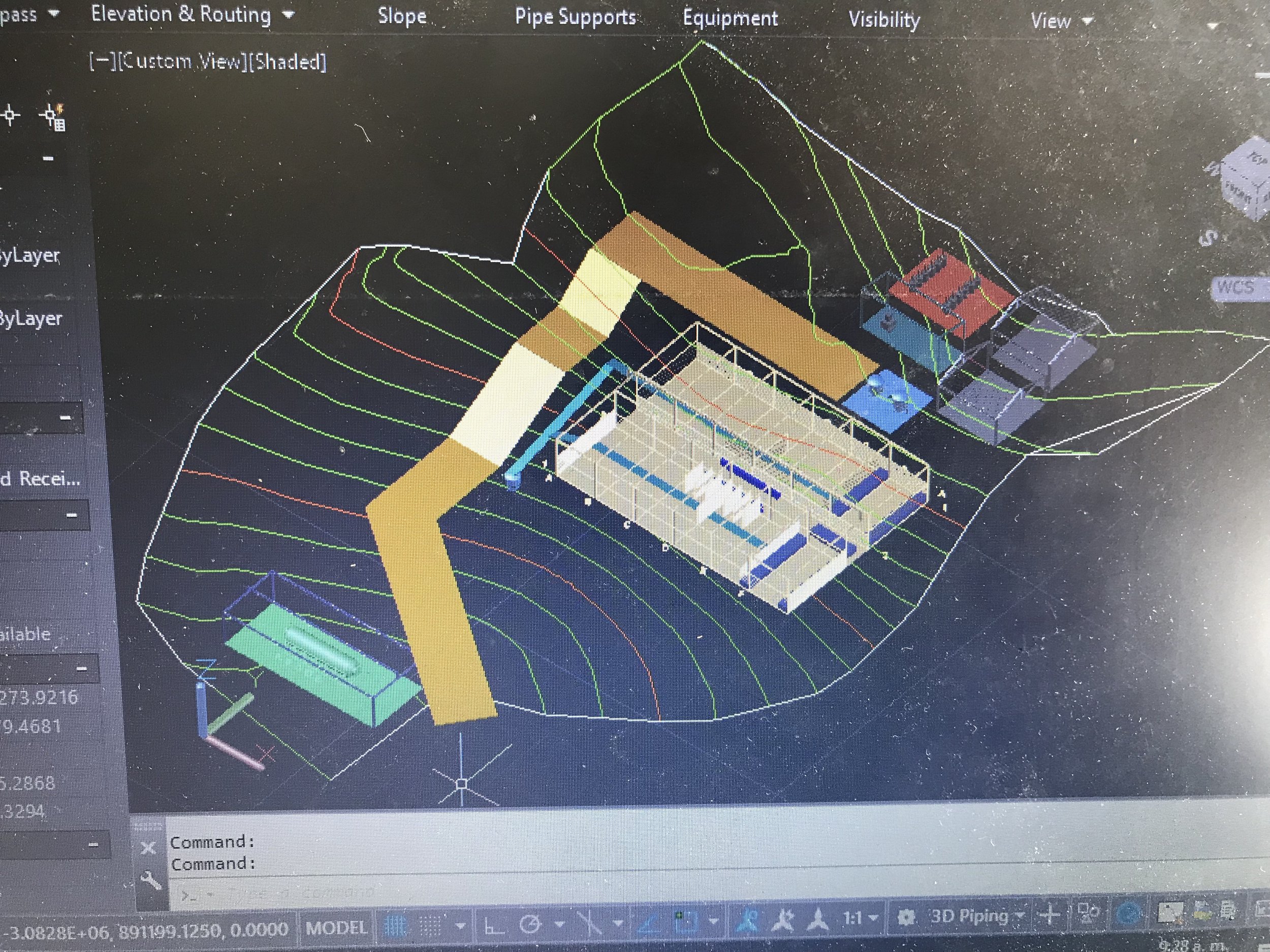

We want to stay close to the people that work here, whether at farm level, washing stations, dry mills, and exporters. The post-processing, the dry milling, is our target of utter scrutiny. CCS’ team and partners will be at all the dry-mills we will use throughout the export season, following up on the milling itself, the sorting and the bagging.

This is where CCS adds value: by knowing the field, finding the lots, presenting well screened and curated sets of coffee, following up with the dry milling and logistics, in short, getting the lot from this place to your place, and financed all the way.

We follow the movements and the trends, but more than anything, we want to convey our respect and understanding of the traditions of a rich culture and elegant coffees that our partners and producers share with us. Still, we do think that there is plenty of room for change and improvement in how things are done in the field of making specialty coffee in Ethiopia. That is why we are here. This is why we will stay.

You are welcome to join us at CCS’ cupping lab with our partners Snap Specialty Coffee on Bole Road, 12th floor. Join our upcoming origin trip, or contact me to make another time to cup with us.

If you cannot make it here before Feb 15th, we’ll send you a curated set of samples. Contact your sales rep to order them now.