Earlier this month Colleen King, of our US West Coast office, and I visited Valle del Cauca, Colombia. It was CCS’ first official visit to this department which is better known for producing cane sugar, than coffee.

Café Sello Mujer

One of the reasons for visiting Valle del Cauca was to meet the women of Café Sello Mujer in Caicedonia.

Though they only officially formed in December 2017, the group already have a significant project under their belt: the launch of their own brand of roasted coffee. With the assistance of Cafexcoop mill, the group set a quality standard, and all coffees from the last harvest that met that standard, were blended, roasted, ground and packaged by the mill.

This impressive association of women producers has a very clear vision of what they need, and where they want to go. Their number one priority is improving the quality of the coffee. The second priority is increasing visibility of women producers in Colombia.

Left to right: Aneth Choronta, Floralba Peña Peña and Amparo Corrales Baena of Café Sello Mujer women's producer association.

Obstacles faced by women producers in Colombia

Eugenia Balanta, Director of the Cafexcoop mill.

Eugenia Balanta is the director of the Cafexcoop mill and one of only a few women executives in coffee in Colombia.

Eugenia identified several obstacles that women producers face in Colombia that may prevent them from achieving the quality needed to earn a premium for their coffee. Firstly, she said, women struggle to access training programs offered by cooperatives, aid agencies and the FNC. In addition to cultivating coffee, women are expected to care for children and manage the household. If attending a training program requires traveling overnight, very few women can attend, as it would mean leaving their children.

Secondly, even when women are cultivating the coffee, their husbands may be the one making the business decisions. This may include whether or not they can enter their coffee into competitions like Valle Cafetero.

Esperanza Fajardo of Café Sello Mujer agrees that support from men in the family is essential to the success of women producers. Her husband was waiting outside while we discussed their project and obstacles unique to women producers in societies like Colombia’s. While some may view this as a further suppression of women’s rights, Esperanza and her group see it as true equality. Women and men will always coexist, so cooperation is imperative.

The women in this association meet every two weeks, which is a serious commitment, given how far they need to travel. Some of them don’t own a car or a motorbike, so husbands become bus drivers, collecting and returning women from these meetings.

At its core however, Café Sello Mujer is about women helping women. They support each other through “mingas” which are working bees, or barn raising events, where the women work communally on projects on each others’ farms.

They also plan to harness digital media to tell their stories. Very often women in Colombia become producers because fathers, husbands or brothers are killed in Colombia’s long running internal conflict, but while this is part of their story, it is not what defines them as producers. Nor do they want to be presented as the beauty queens of coffee. “We won’t dress it up, we won’t be something else, we will tell our stories how we want them to be told,” said member Aneth Choronta.

The next coffee harvest in Caicendonia is Dec/Jan, and we look forward to cupping coffee from producers of the Cafe Sello Mujer association.

Men wait on "Women's Street" in Caicedonia, Valle del Cauca.

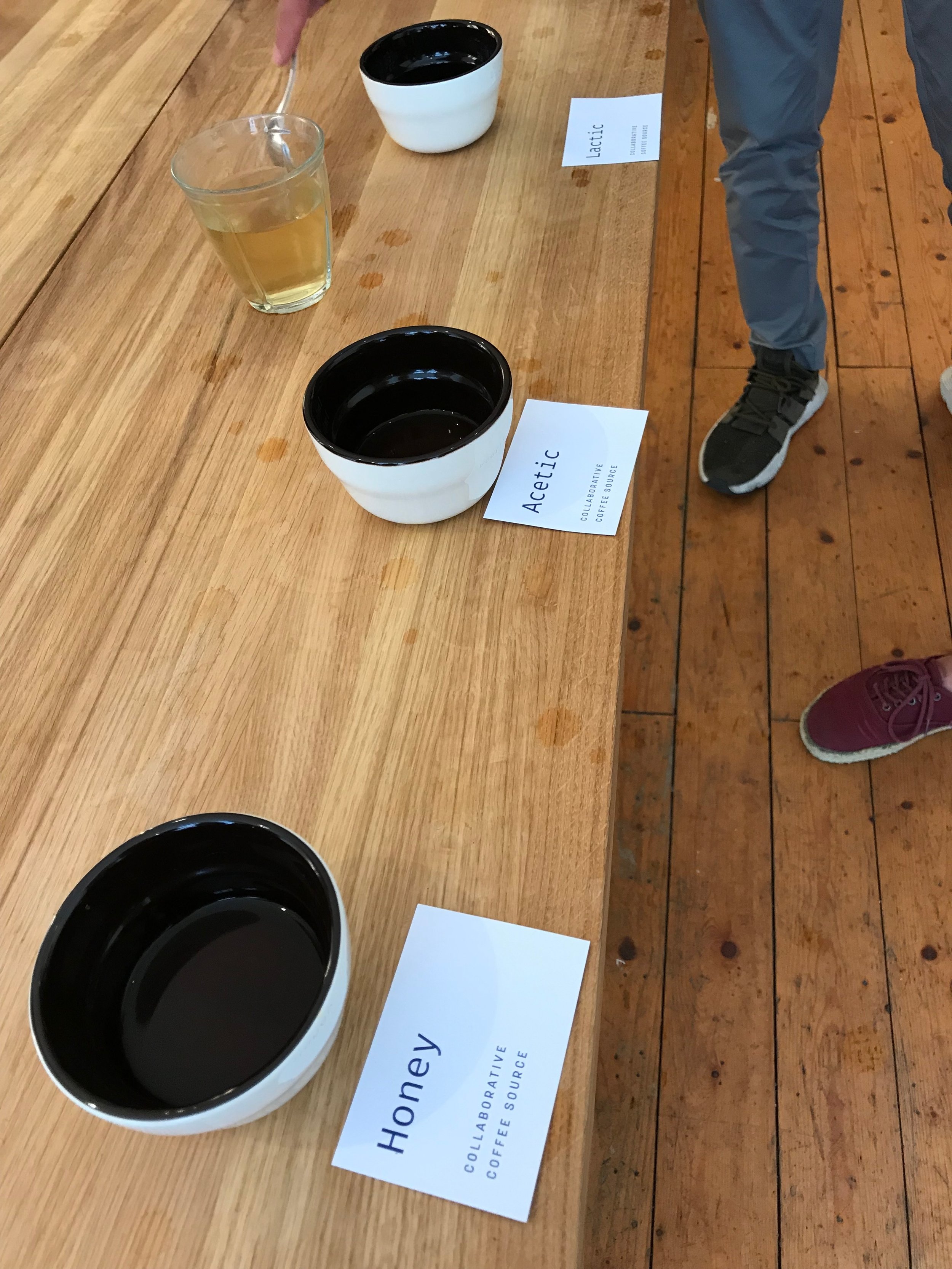

Valle Cafetero Competition

The reason for visiting Valle del Cauca this month was to attend the fourteenth Valle Cafetero competition. The competition was run by the Cafexcoop mill which is owned by the four cooperatives associated with the Federación Nacional de Cafeteros (FNC).

The department is better known for producing high volumes of coffee than high quality, but this competition aims to increase visibility of specialty coffee in the department, and motivate producers to invest in improving quality. Over the last fourteen years of the competition, the scores of the coffees have vastly improved and the range of scores is narrower, suggesting that overall quality is improving every year.

Over 190 coffees were entered into the competition. The Cafexcoop team narrowed these down to 30 for the panel of judges. The top three winners received a cash prize and all of the top 30 coffees were up for sale at a silent auction at the award ceremony.

Twenty-one of the top 30 coffees were sold during the auction. The lowest priced coffee sold at 30% above the current price in Colombia, while the top placing coffee sold well over 500% of the current price.

The majority of the coffees were sold to exporters with South Korean clients. While we didn’t buy any coffees during the auction, we did identify several producers with delicious coffees, and we will be following up with them in the coming months. The event clearly showed this department has great promise.

Business Round

All 30 coffee growers were invited to give a short presentation to the judges before the auction. The intention was two-fold: add value to the coffees by telling the story of the producer, and empower producers to negotiate prices for their coffees. While many of the presentations were more like a sales pitch, such as “my coffee is the best,” the experience was valuable to the producers who described it as terrifying, but also exciting to be a part of the sales process.

ABOUT VALLE DEL CAUCA

Some basic statistics:

- 25,815 fincas in Valle del Cauca

- 61,145 hectares in coffee

- Most specialty is 1500-2100m

- Density of planting is 4768 trees/hectare

- Average age of trees is 7.6 years

- Coffees are grown along the 2 Andes ranges in the department

- 151 microcuencas

- 30.2% of the members of these co-ops are women

- The 4 coops have 3302 members in total

Valle del Cauca is a department located on the Pacific coast, bordered by Chocó, Tolima and Cauca. This department is named after the Cauca river that runs through it, and this river is the basis of their unique approach to coffee cultivation.

The National Federation of Coffee Growers (FNC) divides Colombia into 86 “ecotopos” (ecotopes in English) within seven different coffee growing regions. These ecotopos are geographical areas that share the same soil and climatic conditions. Using this guide, the FNC create sustainable development programs, technical and crop forecasting models, and study the relationship between climatic conditions of the ecotopos and the cup quality they produce.

In Valle del Cauca, the flowing waters of the Cauca River unite the people, so instead of using ecotopes to determine their coffee sustainability strategy, the department uses “Micro-Cuencas” or micro river basins. Micro-Cuencas are the epicenter of the community and the source of coffee quality. Everyone, whether they work in coffee or not, must do their part to ensure the water is respected, because contamination flows downstream and negatively affects everything: the environment, the people, and ultimately, the coffee quality.

Sustainability programs in Valle del Cauca work with the unique ecosystem of each Mirco-Cuenca. They encourage coffee cultivation in harmony with the natural resources, maintaining the balance of the local insect population, stimulating natural fertility of the soil, and conserving the river basin for the future of both coffee cultivation, and the community.